October 17, 2024

Hello there,

I hope everyone has had a chance to break their sweatshirts out, fall is my favorite time of the year. It’s one of the few times of year were sitting on your couch all day Sunday is “reasonably” accepted by most people in your life.

One thing I wanted to call out to everyone is our world-famous Holiday Party is quickly approaching. We like to be the official kick-off of the Holiday Party season so you will notice that we have it the Thursday before Thanksgiving week. If you have not been before, ask someone that has, and hopefully they will tell you it is indeed world-famous. I am including the details below, but you can expect top-tier food, beverages, and conversation. We now have 28 employees under the roof at 910 Madison Ave and would love for everyone to be able to meet all the team.

Expect to see an email invite soon, but here are the details if you want to block your calendar until the formal invite:

Date: Thursday, November 21st

Location: Connetic / Wendal Office

Time: 5:00PM – 8:00PM – Open-house style, come whenever is convenient

Attire: Smart Casual / Business Professional

Food / Drink: Catering from Jeff Ruby’s, full bar, high-end bourbon tasting, and more.

In today’s update:

- The Power Law in Venture Capital: Why Diversification is Key

- Data: The Calm Edge – Unemotional Startup Founders Achieve Higher Success Rates

- Connetic Corner

- Super Interesting Reads:

- Fisker’s HQ abandoned in “complete disarray”

- Nvidia just dropped a bombshell

- iCapital Reaches $200B in Global Assets

- Cool AF

- Fund Fact Card

The Power Law in Venture Capital: Why Diversification is Key

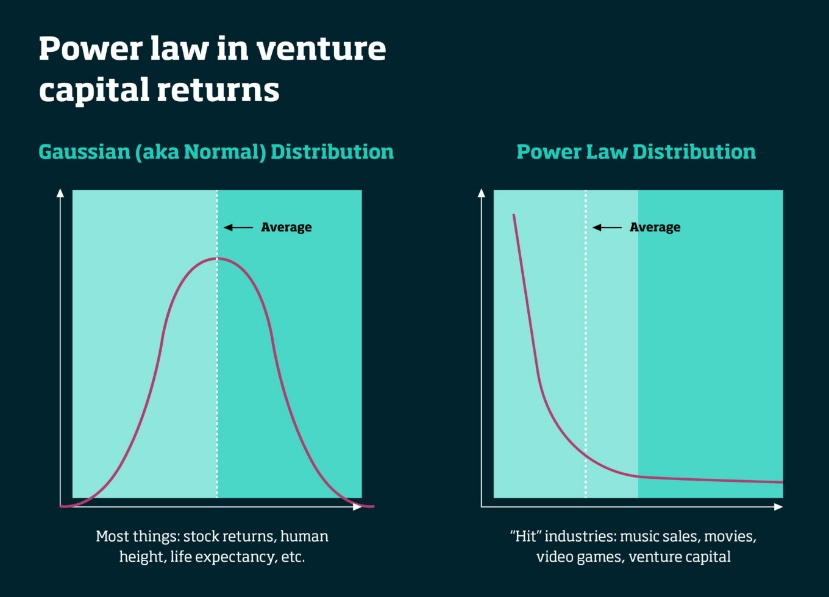

Venture capital (VC) returns follow a power law distribution, where a small number of investments generate the majority of returns. In this model, the top 1% of companies deliver outsized gains, while many others may result in only modest returns or even losses. Y-Combinator reportedly made 75,000x their money on the Airbnb IPO.

This reality makes it critical for VC investors to back many startups, increasing their chances of capturing that elusive “unicorn” company. By investing across a broad portfolio, investors can better position themselves to benefit from the few massive successes that drive overall performance. This is exactly the strategy Connetic is taking and has been taking since inception.

In a study by Steve Crossan, founder of Dayhoff Labs and partner at DCVC, he modeled sample outcomes of VC funds using historical averages to predict the likelihood of <1x, 3x, 5x and 10x (return on capital invested) funds based on number of portfolio holdings. We are motivated by the compelling results in this recent study which supports Connetic’s strategy. We believe as our portfolio size increases, our return on capital will grow linearly.

This power law dynamic in VC contrasts sharply with the returns seen in private equity (PE) and public stock markets. PE typically targets more mature companies with established cash flows, leading to more stable, predictable returns that align with a normal distribution. Similarly, stock market investments, while subject to market volatility, tend to produce relatively modest, consistent returns over time. In VC, however, the disproportionate impact of the few major winners underscores the importance of a diversified, high-volume investment approach to achieve the desired long-term results.

Source: Fabrice Grinda – Playing with Unicorns – How VCs Evaluate Startups

Data – The Calm Edge: Unemotional Startup Founders Achieve Higher Success Rates

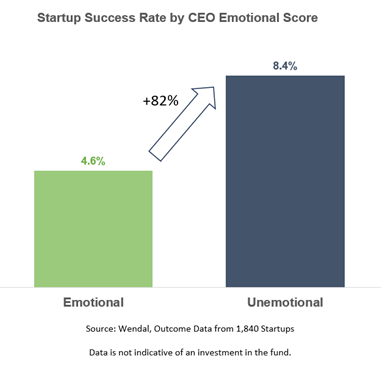

Unemotional startup founders tend to achieve higher success rates compared to their more emotional counterparts, as indicated by Wendal data1. One possible reason for this could be that unemotional founders are better equipped to make rational, data-driven decisions, especially in high-pressure situations common in the startup environment. They may handle setbacks and criticisms with a level-headed approach, allowing them to pivot strategies effectively without becoming overly attached to a particular idea or outcome. Additionally, their calm demeanor can foster a stable work environment, boosting team morale and productivity. In contrast, highly emotional founders might struggle with stress management, leading to impulsive decisions that could jeopardize the startup’s growth.

1. Data through 10/8/2024. Sample is 1,840 startup companies that applied for funding through Wendal between 1/1/2019 and Wendal has classified as having an outcome. Data may not be indicative of all startup founders and outcome data as well as conclusion may change over time.

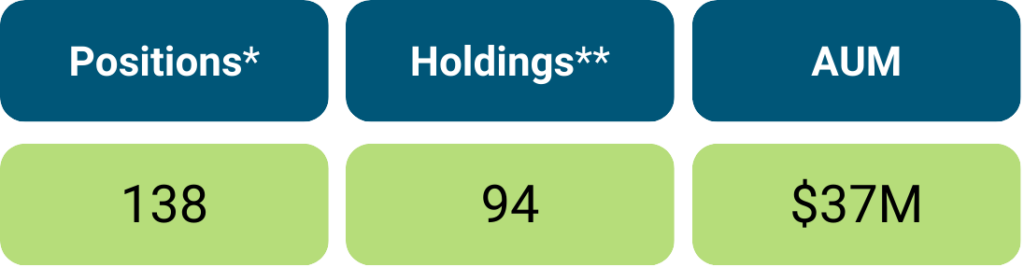

Data – AUM & Portfolio Count as of October 16, 2024

* Positions – The Fund may hold multiple positions in each private company

** Holdings – distinct individual company

As many of you know, VCAFX officially launched on 10/3, and we’ve been knee-deep in streamlining operations and getting ahead of all the fun that comes with being the adviser to a 40-act fund! On a personal note, this past year has been both the most challenging and the most rewarding of my career (a bit of a rollercoaster, but hey, that’s what makes it exciting!).

Looking back, it’s amazing to see how far Connetic has come and how we’ve shaken things up in the Venture Capital (VC) world. Six years ago, we saw the cracks in the traditional VC model and founded Wendal—an AI-driven, automated VC diligence tool. Back then, most VCs thought we’d lost it, but founders loved it. Fast forward to today, and now nearly every VC I talk to wants a demo! Funny how that works, right?

Then, two years ago, we took on another challenge—the outdated VC fundraising model. Enter VCAFX. Once again, founders are loving it, and VCs are skeptical. I’ve got a feeling in a few years; they’ll be chasing us just like they did with Wendal. Only time will tell! 😊

If you want to learn more about VCAFX, Brad will be hosting Informational Calls every Tuesday for the next few weeks: 10/22, 10/29, and 11/5 from 12pm-1pm EST.

You should have received the invites from Brad but if you haven’t please contact one of us: hjelm@conneticventures.com or bzapp@conneticventures.com

Super Interesting Reads

Cool AF of The Week

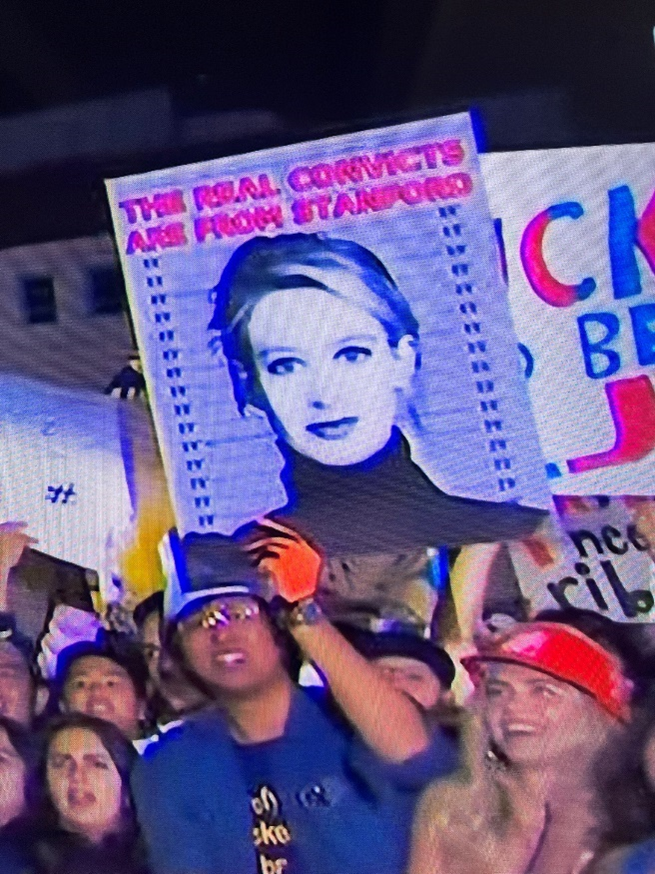

A+ sign from the University of California vs. Stanford game.

Thanks for reading! Share using the buttons below

For more information check out our Monthly Fact Card

Follow Us

Note: This newsletter is for information purposes only, and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or any other product or service referenced herein.

Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectus contains this and other information about the Fund and can be obtained by calling 1-800-711-9164 or by visiting the Fund’s website at https://www.conneticventures.com/vcafx. Please read the prospectus carefully before investing. All investments involve risks, and past performance is no guarantee of future results.

The content herein is for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation in respect to any products or services for any persons who are prohibited from receiving such information under the laws applicable to their place of citizenship, domicile, or residence.

Some statements herein may express future expectations and forward-looking views based on Connetic’s current assumptions. Statements about companies, securities, or other financial information represent personal beliefs and viewpoints of Connetic or the respective third party. These statements may involve known and unknown risks and uncertainties, potentially leading to different results than those implied or expressed. All content is subject to change without notice.

The Connetic Venture Capital Access Fund (the “Fund”) was organized as a Delaware statutory trust on September 11, 2023, under a Certificate of Trust governed by the laws of the State of Delaware. The Fund is expected to acquire all of the assets and liabilities of 908 Investments LLC (the “Predecessor Fund”), a private fund that will merge into the Fund, in a tax-free reorganization on or about October 2024 (the “Reorganization”). In connection with the Reorganization, interests in the Predecessor Fund will be exchanged for Class I Shares of the Fund. The Predecessor Fund had an investment objective and strategies that are, in all material respects, similar to those of the Fund and are managed in a manner that, in all material respects, complies with the investment guidelines and restrictions of the Fund. Connetic RIA LLC (the “Adviser” or “Connetic”) manages the Predecessor Fund.

The Fund is a diversified, continuously offered, closed-end management investment company designed for long-term investors. The Fund is neither a liquid investment nor a trading vehicle.

- Shares are not listed for trading on any securities exchange, and you should not expect to be able to sell Shares in a secondary market transaction. You should consider Shares of the Fund to be an illiquid investment.

- Shares are not redeemable at the shareholder’s option. The Fund does not intend to offer to repurchase Shares until January 2025. At that time, the Fund will offer to redeem no less than 5% of its outstanding Shares four times each year.

- The Fund has no intention to repurchase Shares outside of these quarterly repurchase offers that will begin in January 2025, and these repurchase offers may be oversubscribed.

- If you tender your Shares for repurchase as part of a repurchase offer that is oversubscribed (i.e., because more than 5% of the Fund’s outstanding Shares are tendered for repurchase), the Fund will redeem only a portion of your Shares.

- Because Shares are not listed on a securities exchange, and the Fund will only offer to redeem no less than 5% of its outstanding Shares four times a year starting in January 2025, you should not expect to be able to sell your Shares when and/or in the amount desired, regardless of how the Fund performs. As a result, you may be unable to reduce your exposure to the Fund during any market downturn.

- The Fund is designed for long-term investors. An investment in the Fund may not be suitable for you if you need the money you invest within a specified period.

- The amount of distributions the Fund may pay, if any, is uncertain. There is no assurance that the Fund will be able to maintain a certain level of distributions to shareholders. A portion or all of Fund distributions may consist of a return of capital. Any capital returned to shareholders through a distribution will be distributed after payment of fees and expenses. A return of capital distribution will not be taxable but will reduce the shareholder’s cost basis and result in a higher capital gain or lower capital loss when those shares on which the distribution was received are sold. Once a shareholder’s cost basis is reduced to zero, further distributions will be treated as capital gain if the shareholder holds shares of the Fund as capital assets.

- The Fund may pay distributions in significant part from sources that may not be available in the future and that are unrelated to the Fund’s performance, such as from offering proceeds, borrowings, and amounts from the Fund’s affiliates that are subject to repayment by investors.

- The Fund’s investments may require several years to appreciate in value, and there is no assurance that such appreciation will occur.

- Investing in the Shares may be speculative and involve a high degree of risk, including the risks associated with venture capital investing and the potential loss of your entire investment. See “Risks” in this prospectus.

The Fund is distributed by Foreside Financial Services, LLC.

Connetic RIA, LLC, 910 Madison Ave, Covington, KY 41011