October 3, 2024

Hello there,

Welcome again to any newcomers!

I’m writing this from Hotel Covington. I’m decked out head to toe in NKU gear as I have an event later today. Two things I have to say: (1) the fresh squeezed orange juice is legit, and (2) there is a very fun reason to wear school colors around town; people come up and talk to you.

My server, Genesis, asked me if I went to NKU; I told her no, but my son does and I’m on the Board of Regents. She went onto tell me about her journey. She’s from New Orleans and her family moved here after Hurricane Katrina for a better life, specifically better education (Louisiana is 49th/50th state). She is studying Theater and Digital Marketing and graduates this December, the 1st in her family. I loved hearing how NKU impacted her and just the non-traditional path to get there. Had I been wearing a suit like some lawyer or banker, we never would have had this conversation. Now when she crosses the stage in December, I’ll be there, ready to give her a big high five! I may start all my mornings here and switch between my swag for all my kids’ school (NKU, UC, UK) and see who else I can meet! College is so powerfully valuable for so many things beyond just a degree – these conversations and watching my own kids remind me of it everyday!

Today’s article is a good one! Enjoy some pictures of the NKU event and read on to get the scoop on the SEC declaring the fund effective. I look forward to talking to you soon at our Holiday Party. (SAVE THE DATE: 11/21)

Keep reading to get our SEC update and more below!

In today’s update:

- What Fund Effectiveness Means and Investment Strategies for You

- Data: Growth of Interval Funds

- Connetic Corner: Feels Great!

- Super Interesting Reads:

- Interval Funds Growth

- Global Venture Outlook

- JP Morgan: Alpha Opportunities

- Cool AF: UK BBALL & Psychology

- Fact Card: VCAFX Fact Card

What Fund Effectiveness Means and Investment Strategies for You.

VCAFX Deemed Effective: October 3, 2024, mark the moment!

There is no going back now! We have launched! No kidding we are in orbit on our journey! 🚀 So now what? What do you do? What does this mean? What can you do? Below, I’ll list a checklist of what this means for you and some things you may want to consider going forward.

What this means:

-

No more K1s!!!! Can I get an Amen please?! Trust me when I say, our team is as happy as you are about this one. Your tax reporting will now be a form 1099 and those are due on January 31st. It is customary to receive 1099s about mid-February! It will be posted to your online account, IRA, or brokerage depending on where you hold VCAFX.

-

More deals have the potential to provide more diversification! The best way to allocate to venture deals based on academic research (Portfolio Construction) (very nerdy report) and our own data would suggest we do 150 new deals each year, and have a fund lifecycle before complete turnover of roughly 7-9 years. Meaning roughly 3 years from now, we expect to reach our first peak diversification milestone. I want to stay round for that.

-

The fund is open for additional or new investment with no commitments (unlike private placement funds).1 I don’t know about you, but I love this! It’s so awesome to think about this for my overall allocation. I plan to move a few more thousand dollars into the fund, and I’ll think about it again in a year. When that time is up, I might take some out during one of the quarterly redemption periods, move it somewhere else or I might add more. What I love is the flexibility to do this which is very rare in the private markets.

-

Get ready for daily Net Asset Values (NAV). This is our share price. It started at $10 and it moves every single day, making it super easy to understand the performance. This is a major enhancement over our private fund where we set own values, as VCAFX is subject to PCAOB Audit Standards, and often third party valuation firms and then has to be approved by an independent board of trustees of the fund. We believe that level of rigor admittedly has a slight bias towards being conservative, however, over time we expect to see large upward price movement as new financing rounds set new price and are not subject to discounting. Read along with me and let’s see if I’m right!

If you are a new investor and would consider opening a new account, fill out THIS FORM.

For new investors that want to use an LLC or other legal entity, complete Appendix A HERE.

1VCAFX is subject to investment minimums. Please read the prospectus carefully before investing. VCAFX is neither a liquid investment nor a trading vehicle. Investors in a closed-end fund do not have the right to redeem their shares daily.

FAQs and things to come:

-

How can I see/get access to my holdings in the fund?

This will be a couple more weeks. There will be an online portal (similar to Venture360). We had to move to the software that is a part of the fund administrator and transfer agency to allow for fund reporting to flow or potentially flow to and from brokers and custodians. As soon as the accounts are setup, we will send you an email to sign in. -

How does the $10/share work? How many shares do you receive?

The audited valuations set your account value and we simply divide that by $10 to give you the share count. From there, your values will now float daily, we believe it’s going to be a nice step up in transparency for everyone. -

What K1s will I get for 2024? When and how will I get them?

If you were an investor in SeedFund SPV LLC (bridge fund), you already received your 2024 K1. The K1 was on the 2023 form so it’s a bit confusing. If you need them again, no problem. Reach out to Dawna Theuring at dtheuring@wendal.com. You will also get a 908 Investments LLC (which was the merged entity in private form of Connetic Venture Fund and SeedFund) that will also be issued before year end, so zero K1 issues this year! -

Can I add this to my financial advisor?

YES – Most if not all advisors now have a pathway to receive your account to help you stay on top of it. Simply introduce them to me and I’ll handle it with them. -

What if I want to add additional funds? How would I do that?

Simply fill out THIS FORM if you are an existing investor and mail or drop off a check or wire the funds. -

How would I open a position or show the opportunity to friends and family?

We will have a new website with Fund documents, fact cards, and applications. I am happy to help you directly and I am happy to help you with your financial adviser. Email me at bzapp@conneticventures.com. You can copy and paste this link: https://conneticventures.com/vcafx/ -

Can I just call and ask you questions?

Of course you can. You all have my cell, use it. Also, I am going to do 4 investor calls to have group discussions. Those times will be emailed you to. I suggest you save each date and just hit the Teams link or dial in to the number for the call that works for your schedule. That email will be coming to you soon.

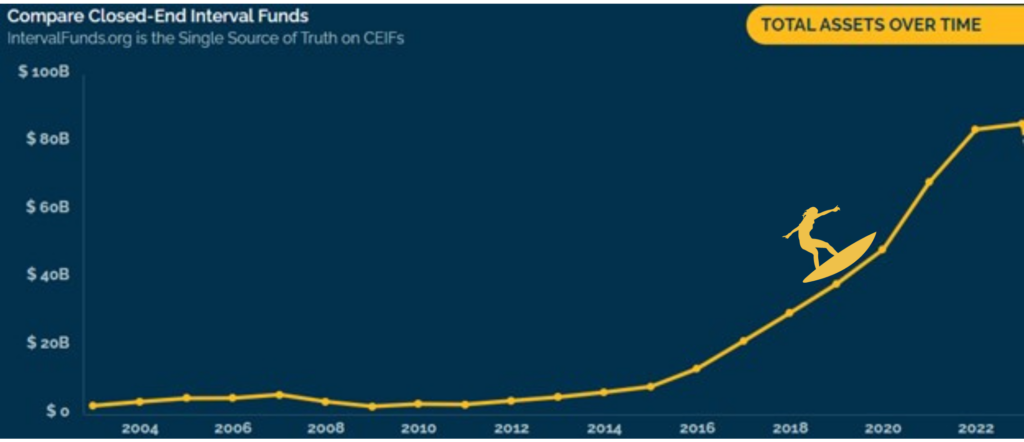

Data – Noticeable Growth in Interval Funds

I have never been on the front end of what some may consider a “mega trend” in the investment world until now. Whether you are an advisor or an end consumer, the interval fund structure has been seeing tremendous growth in recent years and we believe it will continue. Our Fund is an interval fund. Check out this chart and determine if you want to ride the wave.

Source: intervalfunds.org as of 11/12/2023

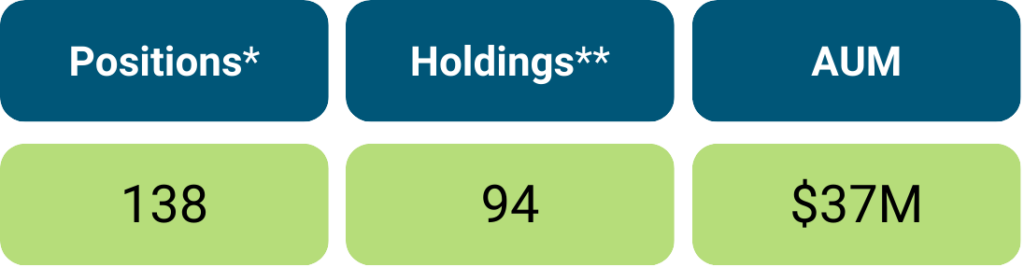

Data – AUM & Portfolio Count

* Positions – The Fund may hold multiple positions in each private company

** Holdings – distinct individual company

The world feels great at Connetic this week. I mean I am fully aware the war has just begun, but we are IN IT! This is just the middle of the race, but today, we are gonna knock off a bit early today, and say cheers to us for staying in the game. Just think, out of the thousands of investment options in the United States and there are only 4 active venture funds. That’s pretty rare. Rarer than any professional sport achievement, and just goes to show you, when you put your mind to do something, you can do almost anything. We did it right here in Covington, KY! We are darn proud of that!

Timing is pretty fun. As we enter the 4th quarter, it will be nice to have a normal reporting period. We also have our Holiday Open House November 21st so I think the holiday cheer and good vibes will be flowing for all. But what does all this mean? In a nutshell, it means its time to hit the street and raise capital. Get these advisors to get us on platform and allocate across their book of business. It’s time for Wendal to prove its mettle and start scaling our newly learned infrastructure and governance processes. Its’ time for us to get kind of loud.

I’ve said it the last couple newsletters, but we need your help. Having a good first quarter would really help all of us.

If you can allocate some more capital to your fund holdings, it would be a big deal for us. You can either just call me, email me (bzapp@conneticventures.com) or fill out this form THIS FORM and wire the funds. We have places to allocate the funds, deals to do, and it would really help our first quarter reporting!

In closing, it feels good here. We are taking this victory and cherishing it this week. Monday will come fast, and we will be ready to go!

Big days ahead 🚀

Super Interesting Reads

Interval Funds Pace for $27B in Capital Formation: Interval Funds $27B of Capital

Global Venture Outlook: The Latest Trends: Global Venture Outlook

JP Morgan: Accessing alpha opportunities

Thanks for reading! Share using the buttons below

For more information check out our Fact Card

Follow Us

Note: This newsletter is for information purposes only, and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or any other product or service referenced herein.

Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectus contains this and other information about the Fund and can be obtained by calling 1-800-711-9164 or by visiting the Fund’s website at https://www.conneticventures.com/vcafx. Please read the prospectus carefully before investing. All investments involve risks, and past performance is no guarantee of future results.

The content herein is for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation in respect to any products or services for any persons who are prohibited from receiving such information under the laws applicable to their place of citizenship, domicile, or residence.

Some statements herein may express future expectations and forward-looking views based on Connetic’s current assumptions. Statements about companies, securities, or other financial information represent personal beliefs and viewpoints of Connetic or the respective third party. These statements may involve known and unknown risks and uncertainties, potentially leading to different results than those implied or expressed. All content is subject to change without notice.

The Connetic Venture Capital Access Fund (the “Fund”) was organized as a Delaware statutory trust on September 11, 2023, under a Certificate of Trust governed by the laws of the State of Delaware. The Fund is expected to acquire all of the assets and liabilities of 908 Investments LLC (the “Predecessor Fund”), a private fund that will merge into the Fund, in a tax-free reorganization on or about October 2024 (the “Reorganization”). In connection with the Reorganization, interests in the Predecessor Fund will be exchanged for Class I Shares of the Fund. The Predecessor Fund had an investment objective and strategies that are, in all material respects, similar to those of the Fund and are managed in a manner that, in all material respects, complies with the investment guidelines and restrictions of the Fund. Connetic RIA LLC (the “Adviser” or “Connetic”) manages the Predecessor Fund.

The Fund is a diversified, continuously offered, closed-end management investment company designed for long-term investors. The Fund is neither a liquid investment nor a trading vehicle.

- Shares are not listed for trading on any securities exchange, and you should not expect to be able to sell Shares in a secondary market transaction. You should consider Shares of the Fund to be an illiquid investment.

- Shares are not redeemable at the shareholder’s option. The Fund does not intend to offer to repurchase Shares until January 2025. At that time, the Fund will offer to redeem no less than 5% of its outstanding Shares four times each year.

- The Fund has no intention to repurchase Shares outside of these quarterly repurchase offers that will begin in January 2025, and these repurchase offers may be oversubscribed.

- If you tender your Shares for repurchase as part of a repurchase offer that is oversubscribed (i.e., because more than 5% of the Fund’s outstanding Shares are tendered for repurchase), the Fund will redeem only a portion of your Shares.

- Because Shares are not listed on a securities exchange, and the Fund will only offer to redeem no less than 5% of its outstanding Shares four times a year starting in January 2025, you should not expect to be able to sell your Shares when and/or in the amount desired, regardless of how the Fund performs. As a result, you may be unable to reduce your exposure to the Fund during any market downturn.

- The Fund is designed for long-term investors. An investment in the Fund may not be suitable for you if you need the money you invest within a specified period.

- The amount of distributions the Fund may pay, if any, is uncertain. There is no assurance that the Fund will be able to maintain a certain level of distributions to shareholders. A portion or all of Fund distributions may consist of a return of capital. Any capital returned to shareholders through a distribution will be distributed after payment of fees and expenses. A return of capital distribution will not be taxable but will reduce the shareholder’s cost basis and result in a higher capital gain or lower capital loss when those shares on which the distribution was received are sold. Once a shareholder’s cost basis is reduced to zero, further distributions will be treated as capital gain if the shareholder holds shares of the Fund as capital assets.

- The Fund may pay distributions in significant part from sources that may not be available in the future and that are unrelated to the Fund’s performance, such as from offering proceeds, borrowings, and amounts from the Fund’s affiliates that are subject to repayment by investors.

- The Fund’s investments may require several years to appreciate in value, and there is no assurance that such appreciation will occur.

- Investing in the Shares may be speculative and involve a high degree of risk, including the risks associated with venture capital investing and the potential loss of your entire investment. See “Risks” in this prospectus.

The Fund is distributed by Foreside Financial Services, LLC.

Connetic RIA, LLC, 910 Madison Ave, Covington, KY 41011