Investment Strategy

The Connetic Venture Capital Access Fund’s investment objective is to generate long-term capital appreciation primarily through an actively managed, diverse portfolio that exposes investors to private venture capital investments.

The Fund seeks to offer all investors an opportunity to gain exposure to a broad range of venture capital investment opportunities typically only available to institutional investors and high-net-worth individuals.

Investment Experience and Innovative Approach

Seasoned Investment Team

The Connetic Venture Capital Access Fund boasts a management team with four decades of active venture capital investment experience, having participated in over 400 private deals. Our extensive network of founders and investors enables us to source high-quality investments across various stages, industries, and geographies.

Proprietary Technology: Wendal

In addition to our industry expertise, we’ve developed Wendal, a proprietary in-house software that:

- Analyzes potential portfolio companies and their team members

- Automates initial due diligence processes

- Creates a level playing field for founders seeking investment consideration

Rigorous Evaluation Process

- Initial Screening: Wendal provides preliminary investment recommendations.

- In-Depth Analysis: Our investment team conducts thorough financial, business, and product evaluations.

- Opportunity Identification: We pinpoint top companies with potential for significant capital appreciation and favorable exit outcomes.

- Final Steps: Upon completion of the evaluation process, our team:

- Negotiates terms

- Determines appropriate allocation based on portfolio construction modeling

This comprehensive approach combines human expertise with cutting-edge technology, with this comprehensive approach we seek to identify and nurture the most promising investment opportunities in the venture capital landscape.

Fund Benefits

CO-INVESTMENT FOCUS

INCREASED DIVERSIFICATION

LOW INVESTMENT MINIMUMS

NO SUBSCRIPTION DOCUMENTS

MINIMAL INVESTOR RESTRICTIONS

DAILY PRICING

QUARTERLY LIQUIDITY*

1099 TAX TREAMENT

*The Fund conducts quarterly repurchase offers for 5% of the Fund’s outstanding Shares at NAV. There is no guarantee that you will be able to sell all of the shares you desire in any quarterly repurchase offer. An investment in the Fund’s Shares is not suitable for investors that require liquidity, other than liquidity provided through the Fund’s repurchase policy. See full disclosures or find more details in the Fund prospectus.

Why Venture Capital

Changing dynamics of the public markets have provided tailwinds to investment opportunities in private market investments.

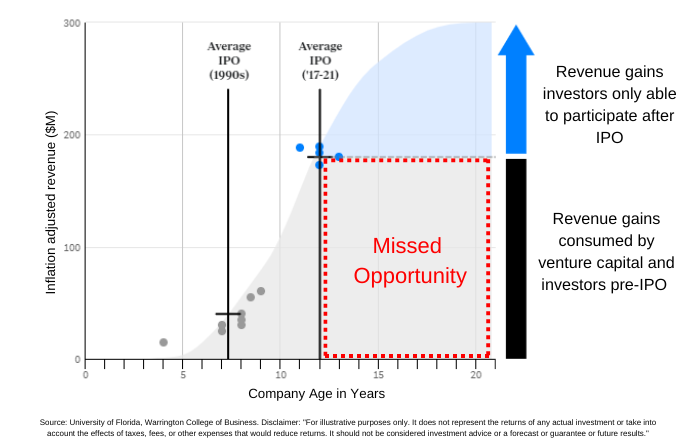

Companies Staying Private Longer

With companies staying private longer, the vast majority of the returns from private tech, based on our observations, has accrued to the private investors before the public offering. Plus, access is gated, with hefty tolls, by fund managers and growth equity firms, just as in the real estate private equity world.

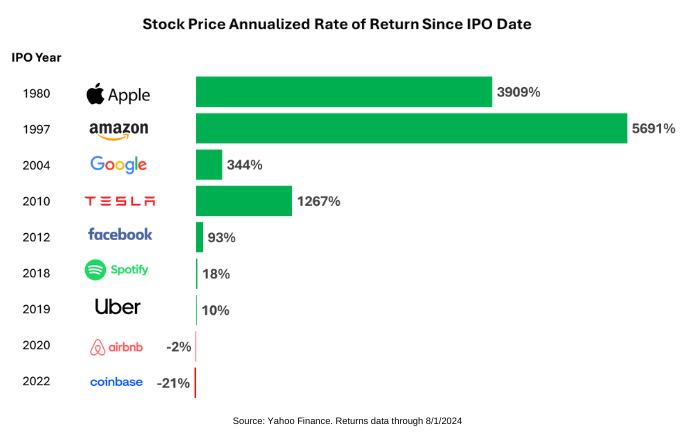

During the 90’s and early 00’s, companies like Amazon and Google went public relatively soon in their growth cycle, while companies today are waiting on average 10 years longer. In our view, individual investors confined to the public markets are missing out on a substantial portion of the returns generated by the next generation of industry leaders.

More Value Created While Private

As companies have stayed private longer, they have raised more capital and increase enterprise value while staying private. This trend may cause less of enterprise value to be obtained by investors post-IPO.

Generational gains may be tough to obtain in specific public market technology companies, but still may be able to be obtained in the private markets closer to company inception.

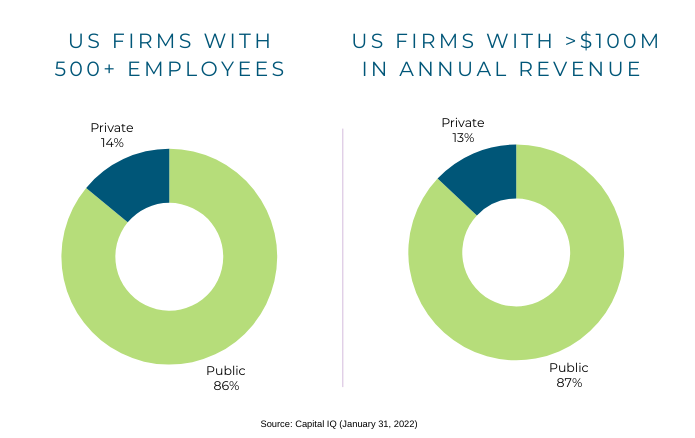

Larger Pool of Investable Companies

The majority of larger companies are not traded on the public stock exchange, most are privately held representing more opportunites for investment. The number of public companies has continued to decrease, over the last 25 years there has even been a 50% reduction in the number of public companies.