November 20, 2024

Hello there,

Again, welcome to a few newcomers, this newsletter is our bi-weekly newsletter to give you insights into our company, useful content, any public portfolio news with cool data and funny pictures!

October was fun, and I feel like its been a while since I said that. We launched our fund on October 3rd with this press release in case you missed it: The LINK NKY: VCAFX Press Release

We closed on our first deal in the new fund, Softdrive, which you can learn a little more about below, and its basketball season which I have high hopes for my KY Wildcats under Coach Pope! I created for myself a mobile tv that I could shuffle out to my firepit and I watched the 2nd UK exhibition, it was fabulous and I highly recommend this experience to anyone!

I get it that exhibitions are not a key barometer of future success, but I needed this after these last couple of years!! Keep reading for further updates and cool info!

And in closing, October is the month we say good-bye to all future rocket ships 🚀 as compliance has told me specifically that rocket ship images are a no go ☹

I’ll try hard to find some other funny emoji that doesn’t give them heart burn.

😊-BZ

In today’s update:

- Interval Funds Comparison Chart

- Data: Golf Database

- Portfolio & Venture News: VCAFX 1st closing: Softdrive

- Connetic Corner: Honey Mystery and Board Members

- Super Interesting Reads:

-

Forbes: Sheryl Sandberg says “Get on a rocket ship” (but she’s really talking about elevators and companies)

-

SpaceX: Updates: Starships (notice its not… a rocket) are meant to Fly!

-

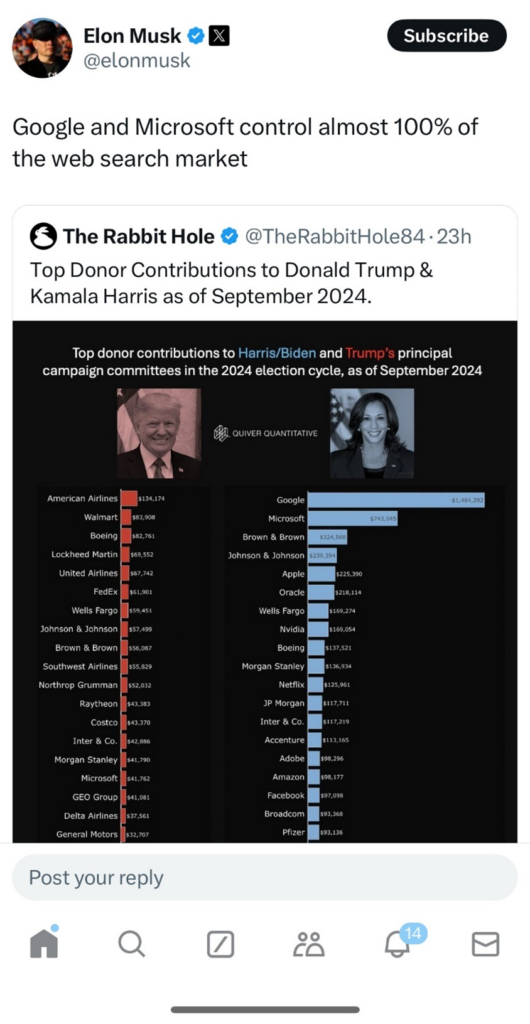

- Stuff That’s Cool AF: Elon Musk Twitter with an Easter Egg

- Monthly Fact Card: October 2024

Interval Funds Growth Chart (2014-2023)

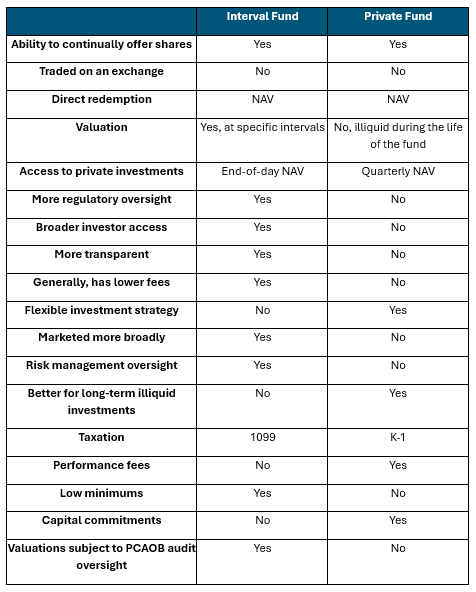

Last newsletter I wrote, I showed you the data chart above on the growth of interval funds. This week, I want to compare the interval fund structure vs the Reg. D private placement structure. Just the structure themselves as a product not any underlying investments. The reason I think this is an interesting conversation is both structures are commonly used for alternative investment strategies and as a certified financial planner, helping everyone understand structural differences is important when considering pieces to your overall asset allocation. Below is a simple matrix chart with categories and below that is 1 sentence commentary on each section.

Reg D Private Placements vs. 40 Act Closed-End Interval Funds Comparison:

Explanations:

1. Liquidity feature differences.

40 Act Closed-End Interval Funds offer periodic redemptions, typically quarterly or semi-annually, making them more liquid than Reg D private placements, which are generally highly illiquid with long lock-up periods often 10 years or longer.

*The Connetic Venture Capital Access Fund offers quarterly repurchase offers that enable investors to sell shares. There is no guarantee that you will be able to sell all of the shares you desire in any quarterly repurchase offer. An investment in the Fund’s Shares is not suitable for investors that require liquidity, other than liquidity provided through the Fund’s repurchase policy.

More details can be found in the Fund prospectus.

2. Which has more regulatory oversight?

40 Act Closed-End Interval Funds are subject to the Investment Company Act of 1940 and are regulated by the SEC, requiring ongoing disclosure and compliance, whereas Reg D private placements operate under exemptions and are not required to register with the SEC.

3. Which allows for broader investor access?

Many 40 Act Closed-End Interval Funds are available to all types of investors, including retail, whereas Reg D private placements are limited to accredited investors (with exceptions in rare cases).

4. Which provides more transparency?

40 Act Closed-End Interval Funds must provide regular financial statements and undergo SEC audits, offering high transparency, while Reg D private placements typically have limited reporting requirements and less transparency.

5. Which structure generally has lower fees?

40 Act Closed-End Interval Funds generally have some lower management fees and no performance fees, typically making them more cost-effective compared to the often higher fees (including performance-based fees) found in Reg D private placements.

*Other fees and expenses apply. See the prospectus for the Connetic Venture Capital Access Fund for more information.

6. Which has more flexible investment strategies?

Reg D private placements allow issuers to pursue a wide variety of bespoke, flexible strategies without the constraints of SEC regulations, unlike 40 Act funds which have stricter guidelines on what they can invest in.

7. Which can be marketed more broadly?

40 Act Closed-End Interval Funds can be marketed to the general public through various channels, while Reg D private placements have limited marketing options, particularly under Rule 506(b).

8. Which has more risk management oversight?

40 Act Closed-End Interval Funds are subject to regulatory constraints that mandate risk management practices, providing more oversight compared to the lightly regulated nature of Reg D private placements.

9. Which tend to be better for long-term illiquid investments?

Reg D Private Placements are often designed for long-term, illiquid investments, such as venture capital or private equity, where investors are locked in for several years.

10. Which has 1099 tax reporting?

40 Act Closed-End Interval Funds issue 1099s to investors for tax reporting, providing clarity on income and gains, whereas Reg D private placements often require K-1s, which can be more complex for investors to handle.

11. Which has performance fees?

Reg D private placements often include performance-based compensation structures like carried interest, particularly in private equity or hedge funds, while 40 Act funds generally do not include performance fees.

12. Which has lower minimums?

40 Act Closed-End Interval Funds typically have lower minimum investment requirements, making them more accessible to a broader range of investors, whereas Reg D private placements often require high minimum commitments.

13. Which has capital commitments?

Reg D private placements often require capital commitments that are drawn down over time, especially in private equity or venture capital structures, while 40 Act funds require full investment upfront.

14. Which structure has valuations subject to PCAOB audit oversight?

40 Act-Closed end interval funds that are subject to PCAOB audit coverage may provide reasonably assured valuations.

I think there is strong reason this structure is showing such growth.

In the coming weeks, I will compare them to feeder funds, fund of funds, and platform fund aggregators. If you want me to explore any topics feel free to email me! – Brad Zapp, CFP®

Data – Golf Database

If you are a golf nut, check this out: Rocket Mortgate Database

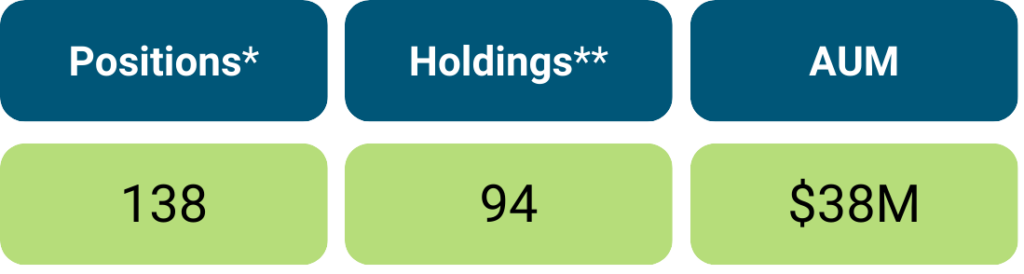

Data – AUM & Portfolio Count

* Positions – The Fund may hold multiple positions in each private company

** Holdings – distinct individual company

Portfolio News – VCAFX 1st closing: Softdrive

We closed on our first investment since launching on October 3rd. The company is called Softdrive, you can check out their website here: https://www.softdrive.co/

Powerful Virtual Desktops, designed for simplicity. Stream the fastest VDI to any device, so your people can stay productive from anywhere.

This is a hybrid work platform technology of the future. The deal came to us through Wendal® out of Ontario, Canada.

The mention of specific securities should not be considered a recommendation. The specific securities identified and described herein do not represent all of the securities purchased or sold for the portfolio, and it should not be assumed that investment in these securities were or will be profitable. There is no assurance that the securities purchased remain in the portfolio or that securities sold have not been repurchased. For the top 10 holdings please see the attached fact card.

So much going on! First, you remember that intern, Lily Moore, who went back to UK for a Masters in Finance? Well, she’s coming back this summer as a full time valuation associate. We couldn’t be any more pleased to add her to the team and expect significant value from day 1. Second thing is I need some help. I have this bottle of honey on my desk, but I cant remember who asked me for it. It’s local honey, from a beekeeper across the street from me, so if you know who you are, or if you are just someone who wants some local honey, hit me up! It’s fresh and great for allergies.

Third item is we are going to need some board members for our portfolio companies. We do not need any expertise other than governance. You should be the type of person that wants to play by the rules, to make sure actions taken at the board level are consistent with what the investment documents say, are ethical and add value to all shareholders. People who are lawyers (I know they suck but they are good at this 1 thing), or work in highly regulated industries of accounting, financing, banking, or are just seasoned at board work, we need you. Just text or email your interest level and any questions and we will add you to our list!

In closing, our world famous holiday happy hour is next week. You don’t want to miss it! We have some upgrades this year and two of my kids will be working the party so come give them, and me, some grief on November 21st at 5pm!

I will see you all soon -Brad

Super Interesting Reads

Cool AF of The Week

Easter Egg alert: Who can spot it? Except you Dad, I already told you 😊

Thanks for reading! Share using the buttons below

For more information check out our website and download our Fact Card!

Follow Us

Connetic Ventures offers investment advisory services and is registered with the U.S. Securities and Exchange Commission (“SEC”). SEC registration does not constitute an endorsement of the advisory firm by the SEC nor does it indicate that the advisory firm has attained a particular level of skill or ability. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Form ADV Part 2A & 2B can be obtained by visiting: https://adviserinfo.sec.gov and search for our firm name.

The Connetic Venture Capital Access Fund (the “Fund”) is a diversified, continuously offered, closed-end management investment company designed for long-term investors. The Fund is neither a liquid investment nor a trading vehicle. Connetic RIA LLC (the “Adviser” or “Connetic”) manages the Fund.

- Shares are not listed for trading on any securities exchange, and you should not expect to be able to sell Shares in a secondary market transaction. You should consider Shares of the Fund to be an illiquid investment.

- Shares are not redeemable at the shareholder’s option. The Fund does not intend to offer to repurchase Shares until January 2025. At that time, the Fund will offer to redeem no less than 5% of its outstanding Shares four times each year.

- The Fund has no intention to repurchase Shares outside of these quarterly repurchase offers that will begin in January 2025, and these repurchase offers may be oversubscribed.

- If you tender your Shares for repurchase as part of a repurchase offer that is oversubscribed (i.e., because more than 5% of the Fund’s outstanding Shares are tendered for repurchase), the Fund will redeem only a portion of your Shares.

- Because Shares are not listed on a securities exchange, and the Fund will only offer to redeem no less than 5% of its outstanding Shares four times a year starting in January 2025, you should not expect to be able to sell your Shares when and/or in the amount desired, regardless of how the Fund performs. As a result, you may be unable to reduce your exposure to the Fund during any market downturn.

- The Fund is designed for long-term investors. An investment in the Fund may not be suitable for you if you need the money you invest within a specified period.

- The amount of distributions the Fund may pay, if any, is uncertain. There is no assurance that the Fund will be able to maintain a certain level of distributions to shareholders. A portion or all of Fund distributions may consist of a return of capital. Any capital returned to shareholders through a distribution will be distributed after payment of fees and expenses. A return of capital distribution will not be taxable but will reduce the shareholder’s cost basis and result in a higher capital gain or lower capital loss when those shares on which the distribution was received are sold. Once a shareholder’s cost basis is reduced to zero, further distributions will be treated as capital gain if the shareholder holds shares of the Fund as capital assets.

- The Fund may pay distributions in significant part from sources that may not be available in the future and that are unrelated to the Fund’s performance, such as from offering proceeds, borrowings, and amounts from the Fund’s affiliates that are subject to repayment by investors.

- The Fund’s investments may require several years to appreciate in value, and there is no assurance that such appreciation will occur.

- Investing in the Shares may be speculative and involve a high degree of risk, including the risks associated with venture capital investing and the potential loss of your entire investment. See “Risks” in this prospectus.

The Fund’s investment objectives, risks, charges, and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company. Please read it carefully before investing. A hard copy of the prospectus can be requested by calling 1-800-711-9164.

More about Wendal: Using technology like Wendal may limit the pool of potential portfolio companies in that the analysis performed is only done on companies that apply. Incomplete, erroneous, limited data, coding and logic errors could lead to incomplete analyses or incorrect recommendations, affecting the Fund’s decision making process. There is a risk that the technologies might not perform as expected in different or changing market conditions.

The Fund is distributed by Foreside Financial Services, LLC.

Connetic RIA, LLC, 910 Madison Ave, Covington, KY 41011