A New Era Of VC Decision-Making

We’ve pioneered the use of data and AI in Venture Capital.

For over 6 years, we have relied on our AI analyst, Wendal, to perform due diligence magic and make investment recommendations prior to a human being involved. Wendal is open to anyone with an internet connection, no warm intros required.

The results have been staggering, not only does it speed up the investment process (which founders love) but it has proven to REMOVE BIAS and make DATA-DRIVEN INVESTMENT RECOMMENDATIONS.

Wendal also tracks and learns off actual startup outcomes.

Wendal Startup Data

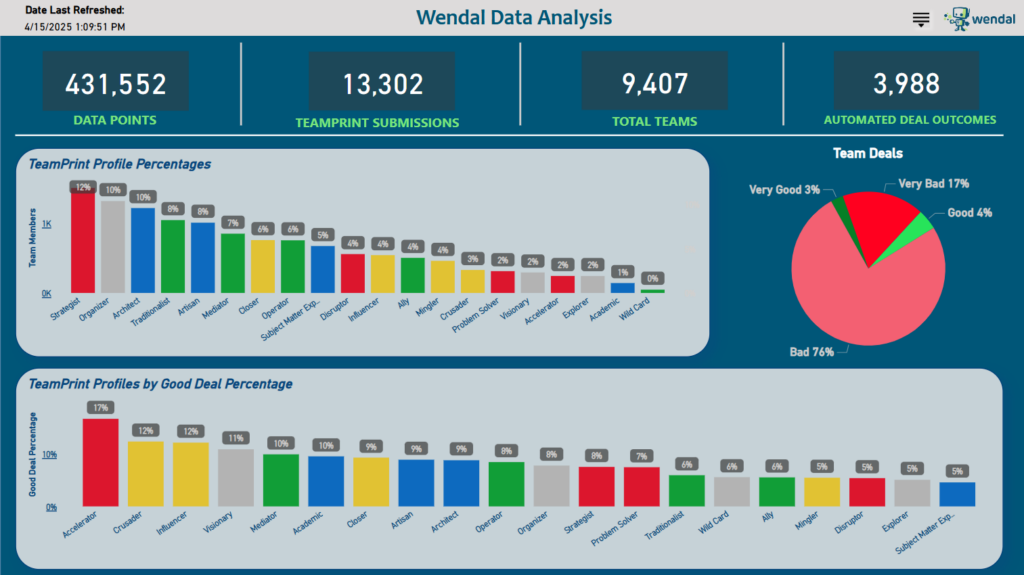

Over the last 6 years, Wendal has analyzed nearly 10,000 teams and has 4,000 outcomes to use for training data.

This is a sampling from our database and a little preview into how we use data to democratize VC. We do in fact have weekly data meetings, have multiple data scientists (and a PhD and neuroscientist), use machine learning, and apply this all to automating venture investing by trying to understand founders at their core.

If you want to learn more, see more data, or partner with us then please reach out to a team member.

More on our Methodology.

Data Collection

Data shown is proprietary data collected from

Connetic Ventures Due Diligence process starting on 9/1/2019 and live through today.

We have over 100 PowerBI reports ranging from behavioral traits that make the most success founders to ideal founder dynamic duos.

Data spans industries & geographies, but mostly concentrated among early-stage startup (Series A & earlier).

Definitions

Startup Outcomes: Startups in our database that have an associated (good or bad) outcome.

Startup Won: Startups that made all shareholders money.

Startup Lost: Startups that did not return all capital to investors.

TeamPrint and Profile Names: These are names created & owned by Wendal Inc.