January 23, 2025

Hello there,

Welcome again to any newcomers!

This is our biweekly newsletter where we talk venture capital (“VC”), Connetic, data, and sometimes funny stuff. Hope you enjoy and read to the end!

As we kick off the new year, it is always a good time to reflect on the prior year, both personally and professionally.

On the business front, 2024 was the most transformational and difficult years at Connetic as we launched our 40-act mutual fund. The process was difficult and learning curve was steep, but personally it was one of the most rewarding years once I was able to reflect on all the work the team did. I’m proud to be part of this group and looking forward to a big 2025.

On the personal front, I won’t reflect on my year… But I did just get back from Disney with my family. And while it’s not my scene, it is insanely impressive how Disney can convince millions of people to pay lots of money to wait in lines all day. It’s a branding masterclass. On a positive note, I did get two hilarious photos of my boys being terrified on the Frozen ride (both front row) so for that I am grateful.

Today’s article is great. I reflect on current VC landscape, fun portfolio updates, and highlight one of our companies that was showcased on Jeopardy.

- In today’s update:

- 2024 Trends Shaping VC in 2025

- Data: 78% of NVIDIA Employees are Now Millionaires

- Portfolio News

- Connetic Corner: Online Accounts

- Super Interesting Reads:

- Toyota Partners with NVIDIA

- Uber and Lyft Gearing Up for Robotaxi Revolution

- Big Ideas in Technology for 2025

- Stuff That’s Cool AF: Jeopardy Answer

- Fact Card

2024 Trends Shaping VC in 2025

As we reflect on 2024 and look forward to 2025, here are a few recent trends that I believe will have an impact on VC landscape in 2025.

- Number of VC Funds Declining

- 2021 and 2022 was not only a year of record private valuations but it also brought with it records of active VC firms. Over the last 2 years, the number of active VC firms have declined, but are still slightly above 2020 numbers. We believe this is healthy for the industry and have already seen startup valuations decline as fewer firms are competing for the same deals.

-

- The most interesting trend in decline of VC funding, is that the funds most impacted are new funds without a track record. Investment dollars appear to be concentrated among established funds with a historical track record. As someone that has been in VC for 8+ years I can attest to steep learning curve in VC as long-feedback loops and market volatility make experience beneficial.

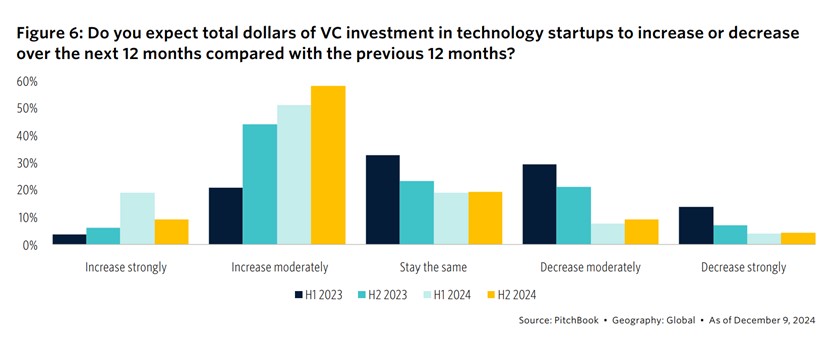

- VC’s Expect Funding Activity to Increase This Year

- Despite the trends of total VCs declining, VCs that remain in market are optimistic about a resurgence in 2025. In a recent Pitchbook survey of 53 VCs, mainly HQ’d in the US, nearly 70% of VC’s expect funding activity to increase over the next 12 months. I would echo the sentiment of VCs in this study and believe VC investment in technology startups will increase in the next 12 months.

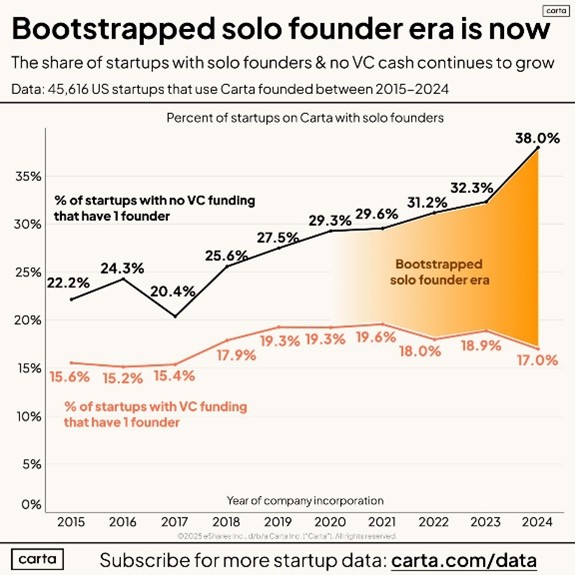

- Rise of Solo-Bootstrapped Entrepreneurs

- According to new data from Carta, nearly 38% of solo founders are not raising VC money, up nearly 2x from 2015. This may be due to advances in AI and work automation. Solo founders represent roughly ¼ of startups so while not the majority of startups this does demonstrate an interesting trend that may continue. We believe that not only is the boom in AI increasing bootstrapped founders but founders that opt to raise VC capital may not need to raise as much, which means founders may not rely as much on large checks from later stage funds.

- Service Titan (TTAN) IPO Provides Optimism Among Future Exit Potential

- 2023 and 2024 were slow years for VC-backed exits, but recent IPO, Service Titan, along with new administration that includes involvement from several tech executives may indicate a more bullish outlook for in M&A and IPO market. According to Pitchbook’s 2025 US Venture Capital Outlook Report, they have 15 VC-backed startups on their list with greater than 87% IPO likelihood in 2025.

After reflecting on the above trends that we are seeing, we believe the venture funding landscape may be shifting in our favor: capital availability is increasing, the number of competing funds is decreasing, potential for more M&A / IPO activity, and declining startup costs mean founders can achieve more with less. As a first institutional check investor with more than 8 years of VC experience, we believe we are well positioned to capitalize on this moment.

Data – 78% of NVIDIA Employees are Now Millionaires

Thanks to its staggering stock appreciation in the last few years, NVDA has a

market cap of $3.6 Trillion (as of January 7th, 2025). 78% of NVIDIA employees are now millionaires when factoring in their stock compensation. One in 2 employees are now worth over $25 Million. Wow, talk about hitching yourself to the right wagon.

The reference to NVIDIA employees achieving significant financial success should not be considered indicative of the outcomes of other venture capital investments. See disclosures at the end of the document for additional risk considerations.

Source: original data Fitch/ post on X by @globalmktobserv

NVIDIA was a VC-backed startup many years ago and is now the world’s second most valuable company. NVIDIA has also started to increase its own VC investment funding 26 startups in 2023 and 2024.

Source: Nvidia Ramps Up Investments in A.I. Startups: Top 10 Bets So Far | Observer Sept. 4, 2024

Data – AUM & Portfolio Count as of December 31, 2024

Venture News

New Investments:

ParkPay USA – Modern parking solution with integrated targeted, context-aware ads based on geolocation data.

Follow-On Investments:

- Scription – Personalized subscription maintenance plans that provide consistent cost, peace of mind, and 3x less equipment downtime

- 1Fort – The AI platform for insurance, risk and compliance.

Notable Portfolio Updates:

Snoots – Snoots, a digital-first vet clinic opened their second location which will be their flagship location. This facility has 8x capacity of their pilot location in downtown London and offers the same affordable £33/month pricing.

Check the Founder and CEO’s LinkedIn post HERE

Quiver Quantitative – In Q4, Quiver partnered with StockTwits to shine light on Congressional Stock Tracking.

Kommu – Launches Kommu for Business. If you know any SMBs looking to explore opportunities outside of traditional corporation lodging then please have them reach out to Kommu!

Outlier – Outlier is expanding its reach to Soccer!

The mention of specific securities should not be considered a recommendation. The specific securities identified and described herein do not represent all of the securities purchased or sold for the portfolio, and it should not be assumed that investment in these securities were or will be profitable. There is no assurance that the securities purchased remain in the portfolio or that securities sold have not been repurchased. For the top 10 holdings, please see the attached Fact Card.

Wendal Gets a Facelift

In the next month we are releasing a brand-new redesign for Wendal, our AI analyst, improving UX to make applying for funding easier and more engaging for startups. The new design has taken years of startup feedback into account and should not only improve application conversion rates but also increase virality and sharing to increase deal flow.

Online Accounts

All investors can now access their accounts and view account balances online.

In the middle of December you should have received an email to login to your account with your user name and temporary password. Most of you have setup your online accounts by now, if you have not please search for the email from Fund Operations at Gryphon Group. If you are unable to find this email or have any issues please email operations@gryphongroup.us and copy bzapp@conneticventures.com.

Super Interesting Reads

- Toyotas next-generation cars will built with NVIDIA supercomputers and operating system, Techcrunch

- Uber and Lyft Gearing up for the Robotaxi Revolution, WSJ

- Big Ideas in Technology for 2025, Andreesen Horowitz

Cool AF of The Week

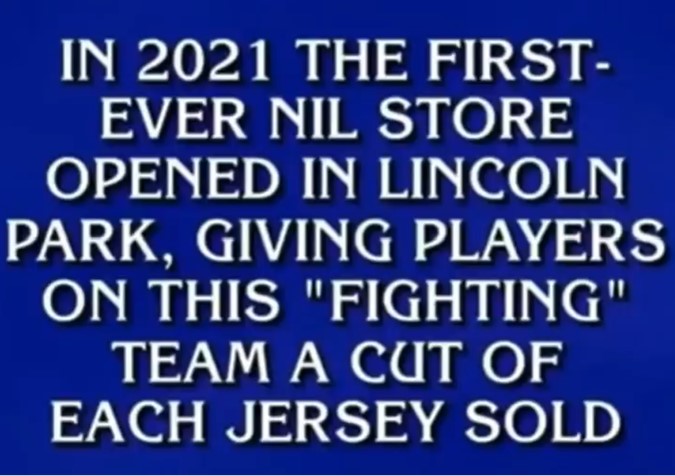

One of our portfolio companies, Campus Ink, was part of a question (although not direct answer) on Jeopardy. They partnered with the University of Illinois back in 2021 to launch the first-ever NIL store. They helped Illinois Basketball players make over $100k in apparel sales with this store launch.

Here is a picture of the store they helped Illinois launch.

Thanks for reading!

We are pleased to partner with these companies to bring you this exciting newsletter.

This newsletter is sponsored by the companies shown above, whose logos and/or names appear as part of this communication. The sponsorship does not constitute an endorsement of any products, services, or investment opportunities mentioned herein. For more information about these companies, click on their logos.

See attached Fact Sheet for additional important information, including the Fund’s top 10 holdings.

Share using the buttons below

Follow Us

Some statements herein may express future expectations and forward-looking views based on Connetic’s current assumptions. Statements about companies, securities, or other financial information represent personal beliefs and viewpoints of Connetic or the respective third party. These statements may involve known and unknown risks and uncertainties, potentially leading to different results than those implied or expressed. All content is subject to change without notice.

The information herein was obtained from various sources. Connetic Ventures does not guarantee the accuracy or completeness of information provided by third parties. The information in this newsletter is given as of the date indicated and believed to be reliable. Connetic Ventures assumes no obligation to update this information, or to advise on further developments relating to it.

Connetic Ventures offers investment advisory services and is registered with the U.S. Securities and Exchange Commission (“SEC”). SEC registration does not constitute an endorsement of the advisory firm by the SEC nor does it indicate that the advisory firm has attained a particular level of skill or ability. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Form ADV Part 2A & 2B can be obtained by visiting: https://adviserinfo.sec.gov and search for our firm name.

The Connetic Venture Capital Access Fund (the “Fund”) is a diversified, continuously offered, closed-end management investment company designed for long-term investors. The Fund is neither a liquid investment nor a trading vehicle. Connetic RIA LLC (the “Adviser” or “Connetic”) manages the Fund.

- Shares are not listed for trading on any securities exchange, and you should not expect to be able to sell Shares in a secondary market transaction. You should consider Shares of the Fund to be an illiquid investment.

- Shares are not redeemable at the shareholder’s option. The Fund does not intend to offer to repurchase Shares until January 2025. At that time, the Fund will offer to redeem no less than 5% of its outstanding Shares four times each year.

- The Fund has no intention to repurchase Shares outside of these quarterly repurchase offers that will begin in January 2025, and these repurchase offers may be oversubscribed.

- If you tender your Shares for repurchase as part of a repurchase offer that is oversubscribed (i.e., because more than 5% of the Fund’s outstanding Shares are tendered for repurchase), the Fund will redeem only a portion of your Shares.

- Because Shares are not listed on a securities exchange, and the Fund will only offer to redeem no less than 5% of its outstanding Shares four times a year starting in January 2025, you should not expect to be able to sell your Shares when and/or in the amount desired, regardless of how the Fund performs. As a result, you may be unable to reduce your exposure to the Fund during any market downturn.

- The Fund is designed for long-term investors. An investment in the Fund may not be suitable for you if you need the money you invest within a specified period.

- The amount of distributions the Fund may pay, if any, is uncertain. There is no assurance that the Fund will be able to maintain a certain level of distributions to shareholders. A portion or all of Fund distributions may consist of a return of capital. Any capital returned to shareholders through a distribution will be distributed after payment of fees and expenses. A return of capital distribution will not be taxable but will reduce the shareholder’s cost basis and result in a higher capital gain or lower capital loss when those shares on which the distribution was received are sold. Once a shareholder’s cost basis is reduced to zero, further distributions will be treated as capital gain if the shareholder holds shares of the Fund as capital assets.

- The Fund may pay distributions in significant part from sources that may not be available in the future and that are unrelated to the Fund’s performance, such as from offering proceeds, borrowings, and amounts from the Fund’s affiliates that are subject to repayment by investors.

- The Fund’s investments may require several years to appreciate in value, and there is no assurance that such appreciation will occur.

- Investing in the Shares may be speculative and involve a high degree of risk, including the risks associated with venture capital investing and the potential loss of your entire investment. See “Risks” in this prospectus.

Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectus contains this and other information about the Fund and can be obtained by calling 1-800-711-9164, by visiting the Fund’s website at https://www.conneticventures.com/vcafx. Please read the prospectus carefully before investing. Click here for prospectus: VCAFX Prospectus All investments involve risks, and past performance is no guarantee of future results.

More about Wendal: Using technology like Wendal may limit the pool of potential portfolio companies in that the analysis performed is only done on companies that apply. Incomplete, erroneous, limited data, coding and logic errors could lead to incomplete analyses or incorrect recommendations, affecting the Fund’s decisionmaking process. There is a risk that the technologies might not perform as expected in different or changing market conditions.

The Fund is distributed by Foreside Financial Services, LLC.

Connetic RIA, LLC, 910 Madison Ave, Covington, KY 41011